Here’s what your Colorado TABOR refund will look like next year

Coloradans will see much less back from the state when they file their taxes in 2026 compared to previous years

Robert Tann/Summit Daily News

Tax refunds for Coloradans in 2026 are expected to be significantly lower than those received in recent years.

Under the Taxpayer’s Bill of Rights, or TABOR, a 1992 voter-approved amendment to the Colorado Constitution, the state must return taxpayer money in years where it exceeds its revenue cap. TABOR limits the state’s revenue collection to the rate of population growth plus inflation.

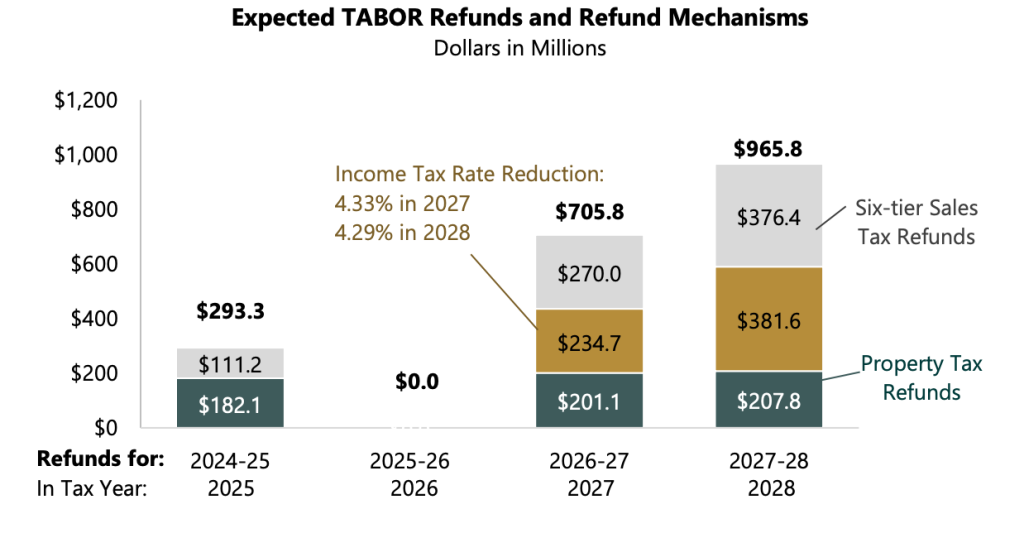

For the current tax year, the state is projected to exceed the TABOR cap by about $293 million, according to a September economic and revenue forecast from the nonpartisan Legislative Council Staff.

That will result in refunds when Coloradans file their taxes next spring. Lower-income filers, who typically pay less in taxes, will receive smaller refunds, while higher-income filers will receive larger refund amounts.

Here’s what Coloradans’ TABOR refunds are expected to look like next year, based on gross income:

- Up to $54,000: $20 for single filers and $40 for joint filers

- Between $54,001 and $110,000: $26 for single filers and $52 for joint filers

- Between $110,001 and $176,000: $30 for single filers and $60 for joint filers

- Between $176,001 and $250,000: $36 for single filers and $72 for joint filers

- Between $250,001 and $329,000: $38 for single filers and $76 for joint filers

- $329,001 and up: $62 for single filers and $124 for joint filers

TABOR refunds issued this past spring, which were for the 2024 tax year, were higher, ranging from $181 to $571 for single filers, and $362 to $1,142 for joint filers. The year before that, Colorado issued a flat refund of $800 to every taxpayer.

The flat refunds, as opposed to the usual income-based method that gives more to higher earners, were approved by state lawmakers as part of a 2023 special session on property taxes. The move was aimed at providing more tax relief to low- and middle-income households.

The smaller refunds in 2026 are due to several factors, including slower economic trends that have resulted in less tax collection by the state.

Nearly two-thirds of this year’s revenue surplus will also be returned in the form of property tax refunds to seniors, disabled veterans, and other Colorado homeowners who fall under the state’s homestead property tax relief program. The remaining surplus will be returned as TABOR refunds, which the state considers a sales tax refund, to all Colorado taxpayers.

While refunds will be smaller in 2026, they’re expected to be zero in 2027. That’s because the state is projected to fall below the TABOR cap for the revenue it brings in, meaning it has no obligation to refund taxpayer money.

Budget forecasters, who presented the findings to members of the legislature’s Joint Budget Committee on Monday, Sept. 22, attributed the revenue decrease to the slowdown in the state’s economy as well as the immediate impacts of congressional Republicans’ and President Donald Trump’s major tax and spending measure, which became law in July. Dubbed by Trump as the “one big, beautiful bill,” the measure overhauled the federal tax code by extending and expanding a suite of tax cuts.

Those cuts led to roughly $1 billion in lost tax revenue for Colorado in the current fiscal year’s budget, which began on July 1 and runs through June 30, 2026. That brought the state below the TABOR cap for the first time since fiscal year 2019-2020.

The state was able to use some of that money that would’ve exceeded the cap to offset the budget deficit, and lawmakers reconvened in August for a special legislative session to help plug the remainder of the hole. Gov. Jared Polis also enacted mid-year budget cuts to close the deficit.

A revenue surplus and, by extension, TABOR refunds are expected to return in 2028. Forecasts say that this is due in part to a continuation of revenue that was generated during the special session, as well as a lower TABOR cap due to lower inflation and population growth.

Refunds in 2028 are projected to be slightly higher than what Coloradans are getting in 2026, but still well below previous years.

Support Local Journalism

Support Local Journalism

Readers around Steamboat and Routt County make the Steamboat Pilot & Today’s work possible. Your financial contribution supports our efforts to deliver quality, locally relevant journalism.

Now more than ever, your support is critical to help us keep our community informed about the evolving coronavirus pandemic and the impact it is having locally. Every contribution, however large or small, will make a difference.

Each donation will be used exclusively for the development and creation of increased news coverage.